Northern Ireland is the second most expensive UK region for home insurance with Newry Mourne and Down District the most expensive in NI at £189

Homeowners in Northern Ireland can expect to pay an average of £171 for a standard home insurance policy, that’s 30% more than the rest of the UK, according to figures released today by insurance comparison website CompareNI.com.

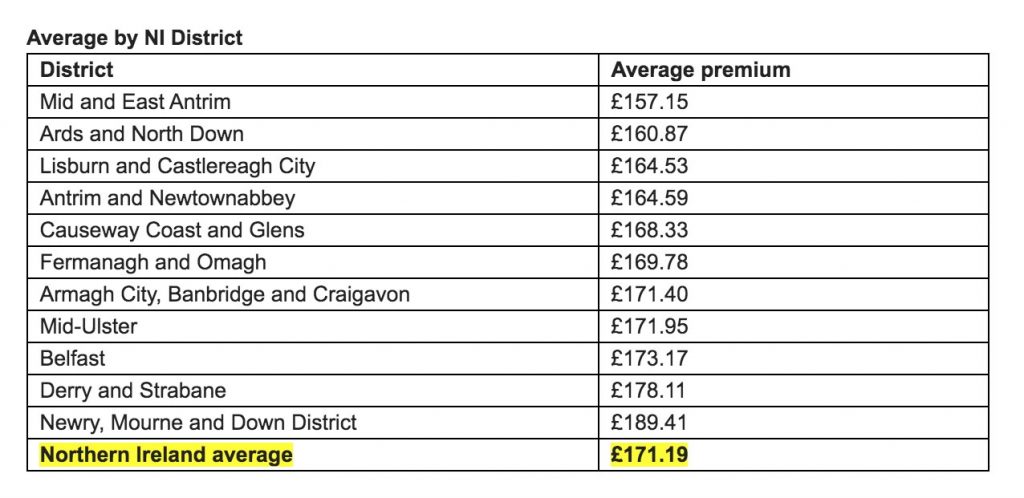

Incredibly, in County Down, the Ards area is the cheapest and the Newry Mourne and Down area is the most expensive for home insurance.

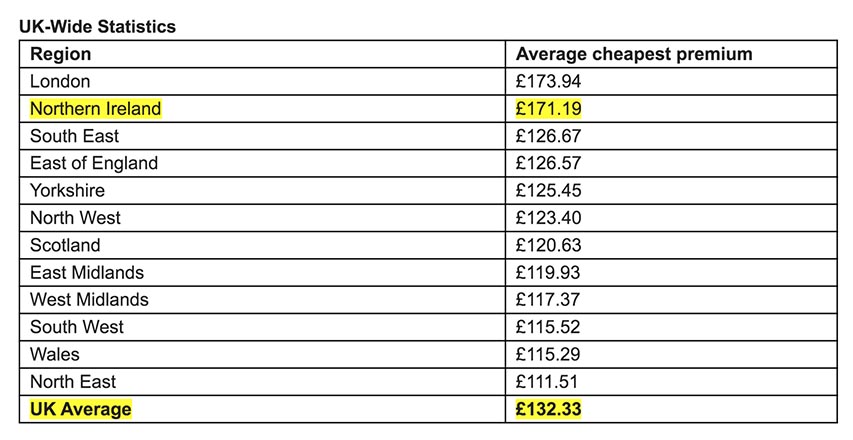

Out of the 12 UK regions, Northern Ireland was only beaten by London in terms of most expensive costs for standard building and contents home insurance, with London clocking in at just £3 more at £174. That’s 30% more than the UK average of £132, the cheapest being the North East with an average of just £112.

Interestingly, the survey showed little variation in the actual property type with just £25 separating the range from the most expensive, a detached house at £149 and a terraced house, least expensive at £124.

The new Home Insurance Index, launched today by CompareNI.com, is based on a sample of over 20,000 standard UK properties, and uses the cheapest home insurance premium offered to each policyholder to calculate regional and national averages.

On a district level, CompareNI.com’s data reveals that homeowners in the Newry Mourne and Down area pay the highest home insurance premiums in Northern Ireland, with an average premium of £189 for a standard buildings and contents insurance policy.

People in Ards and North Down area benefit from the cheapest home insurance quotes, with the average premium in that region coming in at just £160.

Responding to the new data, Greg Wilson, founder of CompareNI.com , said: “Most homeowners have mortgages, which means they usually have a contractual obligation to take out home insurance. However, it isn’t always obvious what’s a fair price to pay for a standard building and contents insurance policy, which is the issue our new Home Insurance Index is designed to address.

“In Northern Ireland we have a slightly different legal system to the rest of the UK – mainly, as a general rule, insurance pay-outs tend to be higher. This can mean insurance policies can be more expensive, to cover the higher rate of compensation.

“Of course, these are averages and the actual cost of a policy can vary dramatically from one insurance provider to the next – which is the very reason we created our price comparison website, to help policyholders compare policies and prices from dozens of different providers side by side in order to find the best deals.

“We will be updating our Home Insurance Index on a quarterly basis, which will give homeowners greater transparency around home insurance costs at any given time as well as an understanding of whether premiums are trending upwards or downwards over time.”

CompareNI.com has grown to become Northern Ireland’s number one price comparison platform, for more information visit: