Private Rent across the Newry Mourne and Down District Council area has increased over the past 12 months by almost 10%

New government data issued on 16th August, analysed by CompareNI.com, has shown Northern Ireland has had the highest increase in private rent than any other country in the UK.

The data showed that private rental prices in Northern Ireland increased by 9.2% in the 12 months to May 2023.

The annual rate for Northern Ireland has slowed since it peaked at 10% in the 12 months to March 2023, but remains significantly higher than all other UK countries.

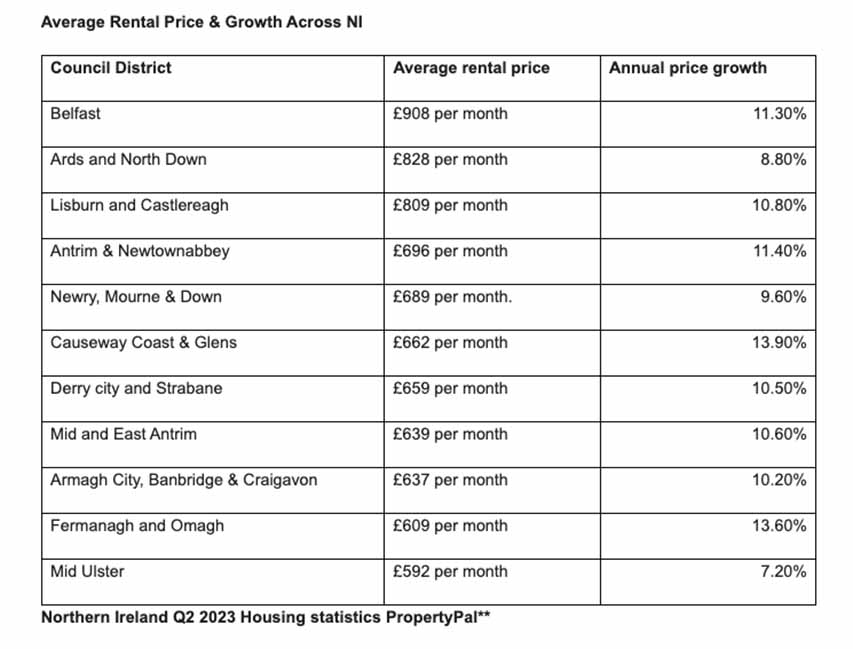

Newry Mourne and Down is fifth in the council table averaging at £689 per month for a rent showing a leap of 9.6% since last year.

In comparison, for the same time period, annual private rental prices increased by 4.9% in England, 5.0% in Wales, and 5.4% in Scotland.*

A recent report by a local property website detailed the soaring average cost of rent in regions across Northern Ireland.

The highest costs on average were in Belfast at £908 per month, Ards and North Down at £828 per month and Lisburn and Castlereagh at £809 per month.

Causeway Coast & Glens saw the highest annual rate of rental price growth at 13.9%, averaging £662 per month, closely followed by Fermanagh and Omagh with an annual rent increase of 13.6% averaging £609 per month.

With costs becoming unmanageable, a recent survey by housing charity Shelter showed one in three private renters in the UK are now being forced to borrow money in order to pay their rent.

The high demand and lack of supply of rental properties is a persistent challenge, with the market supply down by 10% on Q2 of 2022 figures and market demand up 5% on 2022 levels.

Available houses are disappearing fast, on average, pre-covid houses were on the market for 37 days before they reached let agreed, now the average time is 27 days.**

Commenting on the figures, Ian Wilson, Managing Director of Northern Ireland’s largest price comparison website, CompareNI.com, said: “Rent prices across the country have risen to record highs, with current renters struggling to keep up.

“Supply and demand issues are not just bolstering these escalating prices, they’re making it hard for first time renters to even get in the door.

“There are a number of things first time renters can do to improve their chances of getting a tenancy. Most letting agents will require ID, evidence of employment, evidence of address, suitable referees, and a guarantor, sometimes even before viewing the property, so it’s important to have these documents ready to go in order to beat the fierce competition.

“Setting up alerts can also help to make sure you’re quick off the mark when a new place becomes available – helping to ensure you’re amongst the first to know.

“For those already renting, it’s more important than ever to do all you can to protect your security deposit as chances are you will lose more of it due to the cost-of-living crisis and the increased cost of repairs and materials.

“Doing things like taking photos of prior issues when moving in and taking inventory of damage can help to safeguard the deposit and help avoid having money withheld at the end of the tenancy.

“If you need to make dramatic savings, even temporarily, it could be worth discussing adding a roommate with your landlord, to help spread the costs.

“It’s also important to cover yourself with renters insurance to protect your belongings – don’t forget to inform your insurer each time you move properties.

“Failure to do so will void your policy and leave you vulnerable should you need to make a claim.”

CompareNI.com can help people in Northern Ireland find savings on all sorts of everyday household bills and essentials such as home, health and life insurance.

***

Office for National Statistics (ONS), released 16 August 2023, ONS website, statistical bulletin, Index of Private Housing Rental Prices, UK: July 2023.

The Office for National Statistics Northern Ireland data is a month behind the rest of the UK and is only currently available up to May 2023.