Ulster Bank reaffirms support for farmers in lead up to Balmoral Show

* Bank presents farming and economic update, including the annual Ulster Fry Index

While inflation may have eased in recent months, there are always ongoing issues impacting farm businesses.

Currently the main issue is the wet weather with a continued dry period long over due.

Farmers may need additional cash to help them through a prolonged winter and Ulster Bank is here to provide support where it can.

That’s the message from Senior Agriculture Manager, Cormac McKervey, at an event hosted by Ulster Bank today, ahead of its principal sponsorship of this year’s Balmoral Show which returns to Balmoral Park in around 4 weeks’ time.

Members of the Guild of Agricultural Journalists and other stakeholders joined senior figures from within the bank for an update on a number of key issues facing the local agri-food sector and to learn more about Ulster Bank’s commitment to the industry.

Senior Agriculture Manager, Cormac McKervey, and Ulster Bank’s Chief Economist, Richard Ramsey, updated media, and other invited guests, on the overall health of the local food and farming sectors and provided an outlook on other related economic issues.

They were joined by Ulster Bank’s Head of NI, Mark Crimmins, who encouraged those in the audience to tap into the bank’s knowledge and connections to the agrifood sector and asked for their support.

He added that the Ulster Bank plays a leading role in tackling climate change and grasping the opportunities presented by a new, greener economy.

During his opening remarks, Mr. Crimmins said: “The agri-food sector is a crucial component of our local economy and as such, we remain committed to supporting farmers in what has no doubt been a challenging period for them.”

Cormac McKervey, Senior Agriculture Manager, Ulster Bank, said: “12 months ago this sector was dealing with financial pressures brought about by rising input costs and falling milk prices.

“Despite some of the financial burdens easing, many farmers are still operating in challenging times particularly the weather.

“Continuous high rainfall throughout late 2023 and early 2024 has had a worrying impact and will cause difficulties for lambing and calving, for arable farmers trying to plant spring crops, and interrupt the fertilising schedule for those involved in silage production.

“All of this may cause cash flow issues and we will be engaging with those customers and identifying where we can provide additional support to alleviate some of the more upfront cost pressures.

“Bovine TB continues to be a major source of stress for the sector – both mentally and physically – and we would like to see the planning process improved to help with continuous investment in the sector.

“That said, there are shoots of optimism and it’s important that farmers don’t lose sight of opportunities.

“Land and livestock prices remain strong and stable and falling grain prices have helped farmers livestock farmers to maintain or increase their margins.

“It has been a difficult time for arable farmers with the double whammy of poor weather and lower prices.

“It’s encouraging to see so many farmers make use of undertaking the carbon audit and DAERA is doing a good job directing and supporting farmers along the path of transition.

“It’s also encouraging to learn that many of CAFRE’s agri courses are oversubscribed, ensuring a strong pipeline of farmers in the future.”

The gap between farmer borrowing and farmer deposits has closed over recent years. The debt level remains below £1bn for the 8th successive quarter while deposits are slightly over £600m.

The bank remains keen to lend to the sector.

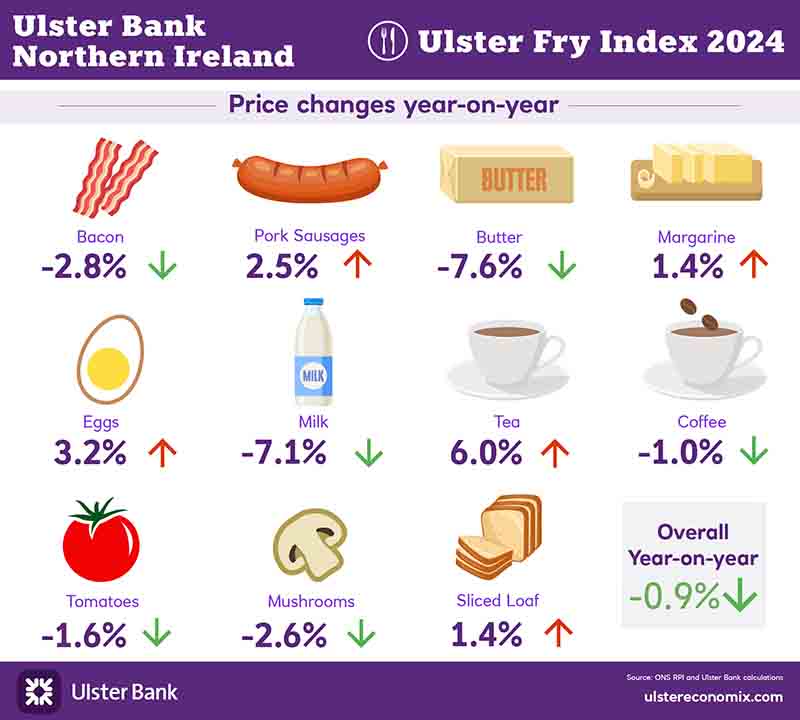

A Slight fall in Ulster Fry Index but still second highest on record

After the sector update, Richard Ramsey presented his annual Ulster Bank Ulster Fry Index which indicates that the average price of all ingredients making up the traditional cooked breakfast plate decreased slightly in the 12 months to the end of February, following last year’s record rise.

Tea saw the biggest price increase in the index with a rise of 6% throughout the previous 12 months.

However, this was slightly offset for brew lovers with a 7.1% fall in milk prices. Rises were also recorded in pork sausages (2.5%) eggs (3.2%) and sliced loaf (1.4%)

Other items which have come down slightly in price since last year’s Index was released include bacon (-2.8%) butter (-7.6%) and coffee (-1%).

Overall, the Ulster Fry Index sits at just 0.9% lower than the 2023 figure which saw the highest increase recorded since Ulster Bank began tracking the index in 2007.

The previous highest rise came in 2009, just after another recession and cost of living crisis.

The price change in the various breakfast items in the Ulster Bank Ulster Fry Index in the past year are contained within the accompanying infographic.

Richard Ramsey says that while food inflation has eased slightly, it is still causing a real concern for households.

“We know that food makes up a significant proportion of household spending and is also one of our most important economic drivers in terms of the local food and drink industry.

“So, understanding how the price of these popular food items change offers a useful insight into the state of typical household finances and also the overall health of the agri-food industry.

“What the Ulster Fry Index is telling us is that while the price of everyday household essentials such as butter and milk have fallen, they are still a long way off their previous positions, and this is continuing to put a squeeze on consumer spending powers.

“While it may appear to be good news initially, the reality is that many of these price decreases are too small and insignificant to fully register at the checkout.

“It’s clear that many households are still struggling to contend with ongoing cost pressures on what would be considered as basic, everyday household items.

Further information about the Ulster Fry Index is available at: