‘Move to Universal Credit’ for farmers and other self-employed people: A burden or a benefit?

Advice NI, Rural Support and the Ulster Farmers’ Union (UFU) have expressed their collective concern over the impact on many of the 134,000 self-employed people in Northern Ireland (NI) who currently rely on tax credits and who will be impacted by ‘Move to UC’.

‘Move to UC’ refers to the UK government’s plan to move ‘legacy’ benefit claimants on to Universal Credit (UC).

‘Legacy’ benefits refer to those working age means-tested benefits that are to be replaced by UC including tax credits, housing benefit, income support, income-based jobseekers allowance and income-related employment and support allowance.

The Department for Communities has confirmed that from 16 October 2023, they will start to issue Migration Notice letters to people in all postcode areas commencing with people receiving working tax credits and/or child tax credits.

Referring to issues particularly affecting the self-employed, Advice NI’s chief executive Bob Stronge said: “Firstly, the Universal Credit system requires the self-employed to report their cash-in and cash-out business figures on a monthly basis.

“This corresponds to their Universal Credit monthly assessment period. Straightaway this will be a real challenge for many self-employed people.

“In addition, Universal Credit normally implements a system of treating self-employed people as earning a ‘minimum income floor’ even if they are not actually earning this amount.

“And unlike tax credits, the Universal Credit system normally has a maximum capital limit of £16,000.”

There are some transitional provisions which will help ease the move for self-employed people from tax credits to Universal Credit.

This may include the 12-month exemption from the minimum income floor and the transitional capital disregard. However, these provisions are temporary and fall away after 12 months.

Kevin Doherty, chief executive of Rural Support,said: “The migration to Universal Credit is something which many farm families are unaware of and will have significant implications for those who rely on tax credits.

“In particular this may impact those with children of school age. No longer is this payment based on annual income, instead figures must be submitted on a monthly basis.

“And no allowance is being made for seasonal income such as lamb sales or single farm payments which has the potential to eliminate any benefit income for several months.

“We know many will struggle with the monthly reporting element and will need additional help at an additional cost.

“Farm families are struggling with the cost of living at a time when farm business margins are also being squeezed.

“They need to be aware of the change to Universal Credit, what is involved and the implications which for most families will see further reduction to their household income.”

UFU deputy president William Irvine said: “The UFU are extremely worried about the new approach to Universal Credit and the impact that it will have on all farm families across NI.

“Due to the nature of farming and working in line with the seasons, there will always be months where expenses are incurred with virtually no income being received.

“However, there will be a period when the Single Farm Payment coupled with the sale of crops and/or livestock will greatly exceed expenditure.

“The process of managed migration to Universal Credit will create huge uncertainty and stress for farm families.

“When farmers receive the majority of their income, and with no allowance for the costs incurred earlier in the year, the income will exceed their expenses to such an extent that there may be no entitlement to any Universal Credit.

“Farm families will have no assurance about whether they will receive Universal Credit at the end of each month which could put them in an extremely difficult financial situation.

“The change to Universal Credit completely dismisses the pattern of income and expenditure for most self-employed businesses, especially farms. A pattern which farmers do not have the ability to change.

“To add to this, the additional requirement of reporting income and outgoings online on a monthly basis will be particularly burdensome.

“Farmers already have so much paperwork to keep on top of and they are based in rural areas where internet access is not always reliable or can be completely non-existent.

“Imposing an online-only method for reporting will severely disadvantage our members and it could force them to seek external assistance creating extra costs for the family.”

Advice NI, Rural Support and the UFU propose that self-employed people should receive a fairer and more equitable assessment under Universal Credit to encourage a more dynamic and entrepreneurial economy and calls for:

- Actual earnings to be used in the Universal Credit assessment as opposed to the artificial assumed ‘minimum income floor’;

- The annualised administration of Universal Credit for the self-employed in line with the tax year as opposed to the requirement for monthly reporting of cash-in and cash-out;

- The creation of a dedicated independent support service for the self-employed to assist and support them to navigate Universal Credit.

If anyone needs help to claim Universal Credit, or they can’t claim by the deadline date given on Migration Notice letter, they can contact the Universal Credit Helpline on freephone 0800 012 1331.

Anyone who is unsure about what UC will mean for them or what support is available, can seek independent advice by going to their local advice centre or calling the

Advice NI FREEPHONE advice Helpline 0800 915 4604.

More information is available at:

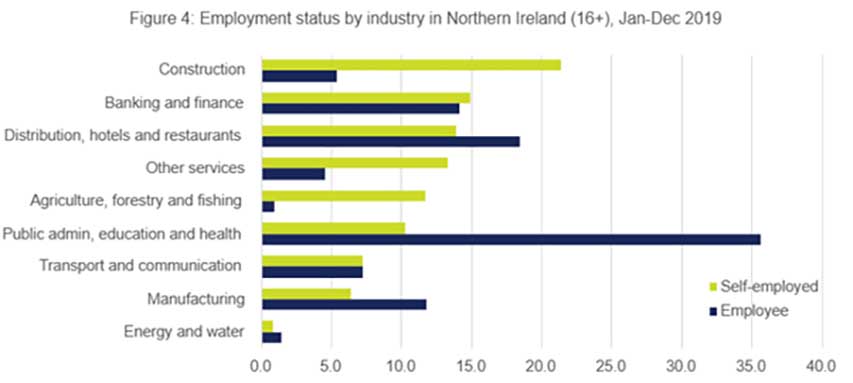

- Graphic: Figure four – Employment status by industry in Northern Ireland.

- Information on self-employment in NI in 2019 can be found at: https://www.nisra.gov.uk/publications/self-employment-northern-ireland-2019.