Northern Ireland Hit Hardest By Free Cashpoint Closure

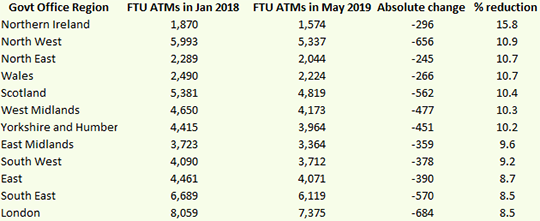

Fresh figures from the consumer group Which? reveal that Northern Ireland has been hardest hit by the recent closure of free to use ATM’s, losing almost 16% in the period January 2018 to May 2019.

Across the UK, one in 10 free cashpoints have either closed or started charging fees since January 2018, with deprived communities disproportionately impacted by the changes.

Anabel Hoult of Which? and Natalie Ceeney of the Access to Cash Review have written to the Chancellor to urge the Government to do more to protect consumer access to cash across the country.

Responding to the intervention and findings, theFederation of Small Businesses (FSB) Northern Ireland Region Chair, Brendan Kearney, said: “Across the UK, millions of small business owners still have customers that want to pay in cash.

“Often these customers are among society’s most vulnerable which includes the elderly, those on tight budgets and those with disabilities. Our members simply must be able to respond to these customers’ demands, or they risk losing that custom altogether.

“It’s vital that banks, regulators and the Government work together to arrest the decline of our cash network, otherwise we risk yet another blow to our High Streets with reduced footfall as bank branches and ATM’s are lost and there is less cashflow in local economies.

“There is no silver bullet here, and we need to think bigger and more collaboratively when addressing this challenge.

“More bank branches need to become community centres – providing meeting rooms, cafes and digital facilities alongside in-person banking support. Elsewhere, you now have a major card provider offering financial incentives to small firms that offer cashback, which is a helpful development.

“The Post Office also has a role to play, and more should be done to improve and standardise its banking offer across locations. Then there are tax incentives to consider – to date, our regressive business rates system has not been kind to shop owners who decide to host a cashpoint and thereby provide a vital public service.

“Freedom is the watchword here. Small business owners must be allowed to go cardless, cashless or accept both cash and card, whatever works best for them. The push for a ‘minimum service guarantee’ must not stray into burdening small firms with fresh rules and regulations.”